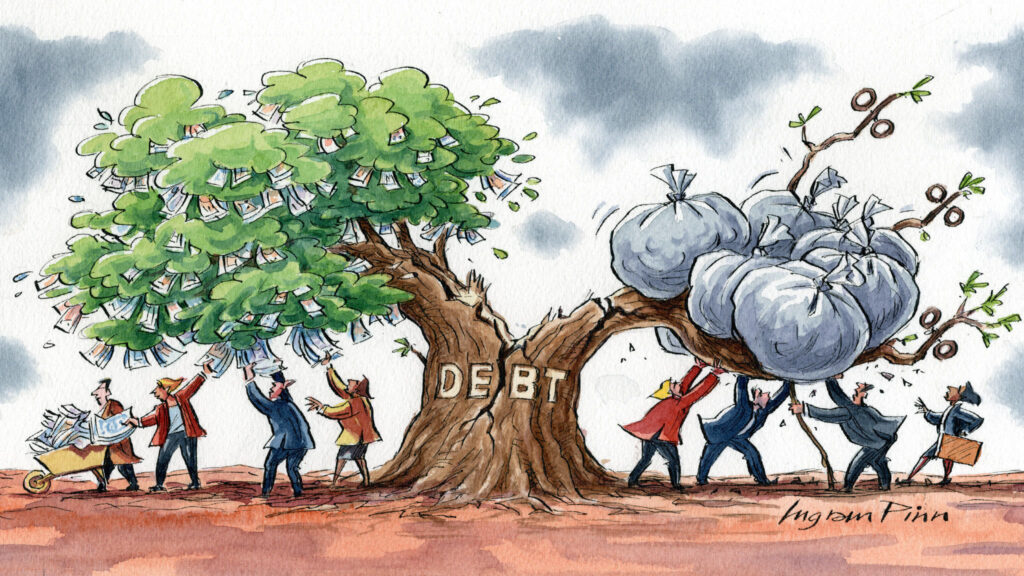

Watch out. That debt is piling up?

After a long wait of 3 years, Tanmay (37) and Renu Gupta (35) finally got possession of their flat in November 2012. Since this was their first home, they decided that they will not cut corners and get the best interior for their flat. After the initial budget estimates, finally they ended up spending 6 lakhs on the furniture and interiors. Having exhausted their entire savings on this house, the couples were left with no choice but to take a personal loan of Rs. 5 lakhs to fund the interiors bill. Already Tanmay was servicing 2 loans- housing loan of Rs. 35 lakhs and Car loan of Rs. 4 lakhs. The latest personal loan ensured that the couple was spending around 59% of their income in servicing all the loans leaving them with a small surplus comprising of 16% of their income. (See box)

Salary | 100000 | % of income |

family expenses | 25000 | 25.00 |

home loan EMI | 38688 | 38.69 |

Car loan EMI | 8696 | 8.70 |

Personal loan EMI | 11376 | 11.38 |

Surplus | 16240 | 16.24 |

The very fact that Tanmay has been working with the same employer for the last 5 years gives him a feeling of security and comfort which has resulted in the increasing pile of debts to cater to the family’s various needs and aspirations. We live in uncertain times today and any major calamity like a job loss at this juncture can leave Tanmay’s family in disarray since he is the only earning member.

With increasing disposable incomes nowadays, the spending pattern with most people has also increased. A lot of times, people end up spending on things which may not be required or buying a product which may be quite expensive than the next best one. To add to it is the comfort of buying your desired product on credit using your credit card. The problem with credit card is that one does not realize how much is being purchased on credit till the time the card does not get blocked stating that the credit limit has been exceeded.

What are the implications: As a rule, one should restrict all the EMI’s to less than 45% of monthly take home income. The moment the limits are exceeded, we are inviting trouble in our lives. The savings component then suffers at the cost of instant gratification and it has a cascading effect on the future financial goals. Lower savings component would mean that either the income has to increase in order to allocate higher amount for future goals or else face the prospect of not being able to meet your financial goals. Excessive borrowing coupled with some missed payments can potentially do a lot of harm to your credit rating which is monitored by CIBIL. Once your credit rating is affected, then there are chances of your loan applications getting rejected in the future.

Excessive debt can also take its toll on your health as you are constantly battling to balance your expenses and EMI payments which can put you under tremendous stress. While debts are sometimes unavoidable but the quantum of debt can be controlled by us. So how does one avoid getting into excessive debts?

Plan your purchases in advance: It’s advisable to plan your big purchases in advance and then start saving for it. For example if you are planning to buy a car, first decide your budget and then start saving for it. If you do not have any other loan, then you might as well take a small loan to make up for the shortfall but remember that the car will result in your overall expenses going up to account for the fuel, servicing etc. Don’t club all your purchases at the same time which will avoid putting stress on your finances.

Secondly differentiate between good and bad loans: A home loan helps to create an asset and it comes with lower interest rates than other loans. It also qualifies for tax benefits which indirectly reduces your servicing cost. But other loans like auto loan, personal loan, do not qualify for any tax benefits and on the contrary are available at higher interest rates. Credit card companies levy between 3.5 to 4% per month on the unpaid balance which makes it the most expensive debt.

Don’t compromise on your contingency fund: Do not empty your coffers to pay for your dream house or car. Maintain at least 3 months of expenses, including your EMI in your savings account. In families having a sole earning member, it’s advisable to maintain 6 months of expenses in liquid form to take care of any uncertain situation.

Steven Fernandes

Chief Planner, Proficient Financial Planners

https://www.business-standard.com/article/pf/watch-out-for-excess-debt-113031600302_1.html